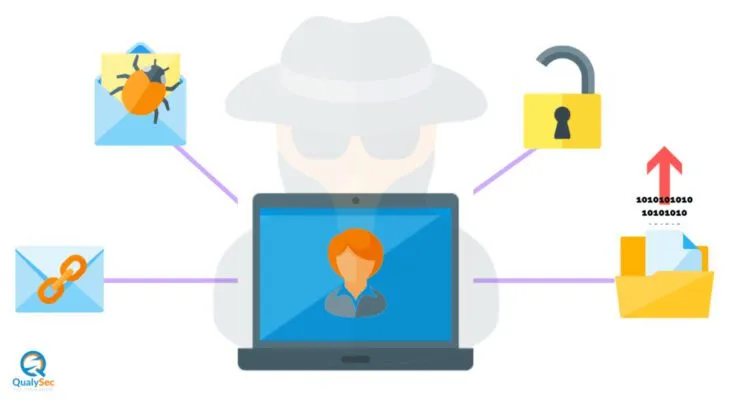

Financial institutions have been attractive hacking targets for many years. This attention has not diminished with the addition of cloud and mobile technology. Quality plays an integral role in the world of technology, without a doubt. QA is way of preventing mistakes and defects in manufactured products. And avoiding problems when delivering products or services to customers. Hence, it is a critical step in the software development process of Fintech industry.

What is the FinTech industry?

It is the technology that aims to compete with traditional financial methods. In the delivery of financial services. It is an emerging industry that uses technology to improve activities in finance. The use of smartphones for mobile banking services, investing and cryptocurrency are examples of technologies aiming to make financial services more accessible to the general public.

Everything from a consumer’s ability to go online and see their financial transactions to allowing you to pay friends to apps that pay bills. Consumers become savvier and more connected. Companies that succeed will be the ones that continue to successfully innovate in bringing new solutions to old problems.

At its core, fintech is utilized to help companies, business owners and consumers. To better manage their financial operations, processes, and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones. Fintech, the word, is a combination of “financial technology”.

How QA Testing helps the FinTech industry

FinTech firms deliver various services, together with equity funding, budgeting, banking, mobile payments, investments, and so on. All of these processes need accessibility, reliability, security, safety, among added features. The main purpose of software QA services and companies is to help to ensure that the Financial Technology products and applications are secure, reliable, and error-free

There are a lot of expectations surrounding Fintech software. These applications have no room for errors. You can blame the sensitive nature of the information with which it works – mainly money and financial assets. While you are operating in Fintech services, there are risks that sometimes you cannot contemplate. Fintech firms deal with numerous sensitive data to process and serve. You need to have a secure, seamless, and powerful interface. There is no avoiding it at all.

As stated already, QA focuses on preventing mistakes and defects in software. The goal is to achieve the best possible product during development to boost the quality of the result. It looks into development processes to check how efficient and effective they are and see if they are up to the quality standards defined for the final product.

QA services need to go beyond the mere look into the processes to ensure a great performance: they need to understand the potential vulnerabilities that may result. QA testing isn’t just about discovering bugs that may be already present in the Fintech software but rather about finding the underlying software development mechanisms that make them appear.

Conclusion

FinTech companies should have a well defined QA testing program. It helps bring to light any areas that may need improvement. We at Qualysec here perform QA tests with our highly qualified and experienced team with the use of latest technology tools. Contact us for more on this.

0 Comments