Because of the importance of the sensitive data they handle, the banking and financial industry is one of the most actively targeted industries for cyber-attacks. Cybercriminals are always seeking system flaws to exploit and steal sensitive information such as personal and financial information.

According to cyber security financial services statistics, the average cost of a data breach in the financial industry globally in 2023 was 5.9 million US dollars, down from 5.97 million US dollars in 2022. Furthermore, the global average cost of a data breach across all industries evaluated was USD 4.45 million.

To prevent such assaults, organizations must undertake frequent penetration testing for financial industry on their IT infrastructure and data. In this blog, we’ll explore the benefits of pen testing in financial organizations. We’ll also shed light on the challenges faced in testing and the threats discovered in the financial industry. Keep reading to learn more.

Talk to our Cybersecurity Expert to discuss your specific needs and how we can help your business.

What are the Threats in Financial Services?

The financial services industry (mostly banks) is facing a slew of security concerns. If hackers gain access to client data and key financial information, all hell will break free! For instance, if the institution does not have in-house security testing skills, partnering with an established security testing provider is helpful.

The following are the main security concerns confronting the financial services sector:

DDoS attacks (Distributed Denial-of-Service)

DDoS assaults degrade website performance, rendering it largely (or totally) inaccessible to end users. DDoS protection technologies might be useful in such situations since they safeguard the site from such harmful attacks.

Malware and Ransomware

Many of these malware and ransomware flaws involve internal personnel who connected to compromised workstations or mistakenly submitted user credentials in phishing campaigns. According to Forbes, ransomware costs over $75 billion in harm to various enterprises each year.

Phishing

Phishing assaults are growing more complex and difficult to detect. In addition, to make their messages look more authentic, attackers frequently utilize bogus email accounts, mimic real website domains, and employ social engineering methods.

Web Application Exploits

HTTP-based web apps all utilize port 80, whereas HTTPS-based applications use port 443. Banking customers should first verify that the website uses the HTTPS protocol; otherwise, their data is not safe.

Cloud Service

While BFSI firms increasingly choose cloud-based services over on-premises storage, their service providers are becoming frequent targets for data breaches. The issue is that cloud solutions with insufficient authentication or encryption security expose BFSI data to hostile attackers.

Benefits of Penetration Testing for Financial and Banking Services

The following are some of the primary advantages that penetration testing provides to the banking and financial services sectors:

- Showcase Genuine Risks

This provides firms with a view into the types of actions that real-world attackers may take. Due to the difficulties in exploiting a potentially high-risk vulnerability, testers may advise firms that it does not constitute a large real danger. Such detailed research necessitates the knowledge of a professional, prompting many firms to outsource their penetration testing operations.

- Examine Cyber-Defense Capabilities and Responsiveness

In the event of a cyber-attack, your defense measures should be able to identify and respond to such situations quickly. When an intrusion is detected, a quick investigation should be launched to identify and block the invaders, whether they are genuine hackers or experts evaluating the efficiency of your security plan.

- Comply with Requirements and Certifications

Penetration testing levels prescribe your industry and regulatory compliance needs. Consider the ISO 27001, PCI DSS rules standard, which mandates all managers and system owners to undertake regular pen testing and security inspections with qualified testers. This is due to the fact that pen testing focuses on real-world implications.

- Customer Data Protection

Banking and financial services firms are responsible for safeguarding their clients’ financial information. Penetration testing identifies weaknesses that might lead to data breaches and protects the security of consumer data.

- Keeping a Good Reputation

Banking and financial services firms rely on client trust to sustain their reputation. A successful cyber assault can harm this reputation and cost the company money. Regular penetration testing aids in the identification of vulnerabilities and the prevention of successful attacks, hence protecting the organization’s reputation and consumer confidence.

- Untrustworthy Third-Party Services

When outsourcing technology and business process services, the security procedures of third-party service businesses that rely on systems become the principal source of vulnerability. Financial institutions also utilize a large number of third-party service providers that operate on the platforms and pose a huge risk to all fintech firms.

- Insights into Security

Penetration testing entails “ethical hackers” attempting to penetrate your network’s cybersecurity and then offering a report and suggestions. The test results advise your security team on how hackers may attempt to circumvent safeguards and where your most major weaknesses are. This allows you to better prepare for current dangers and makes it easier for a program to react to IT’s ever-changing threat landscape.

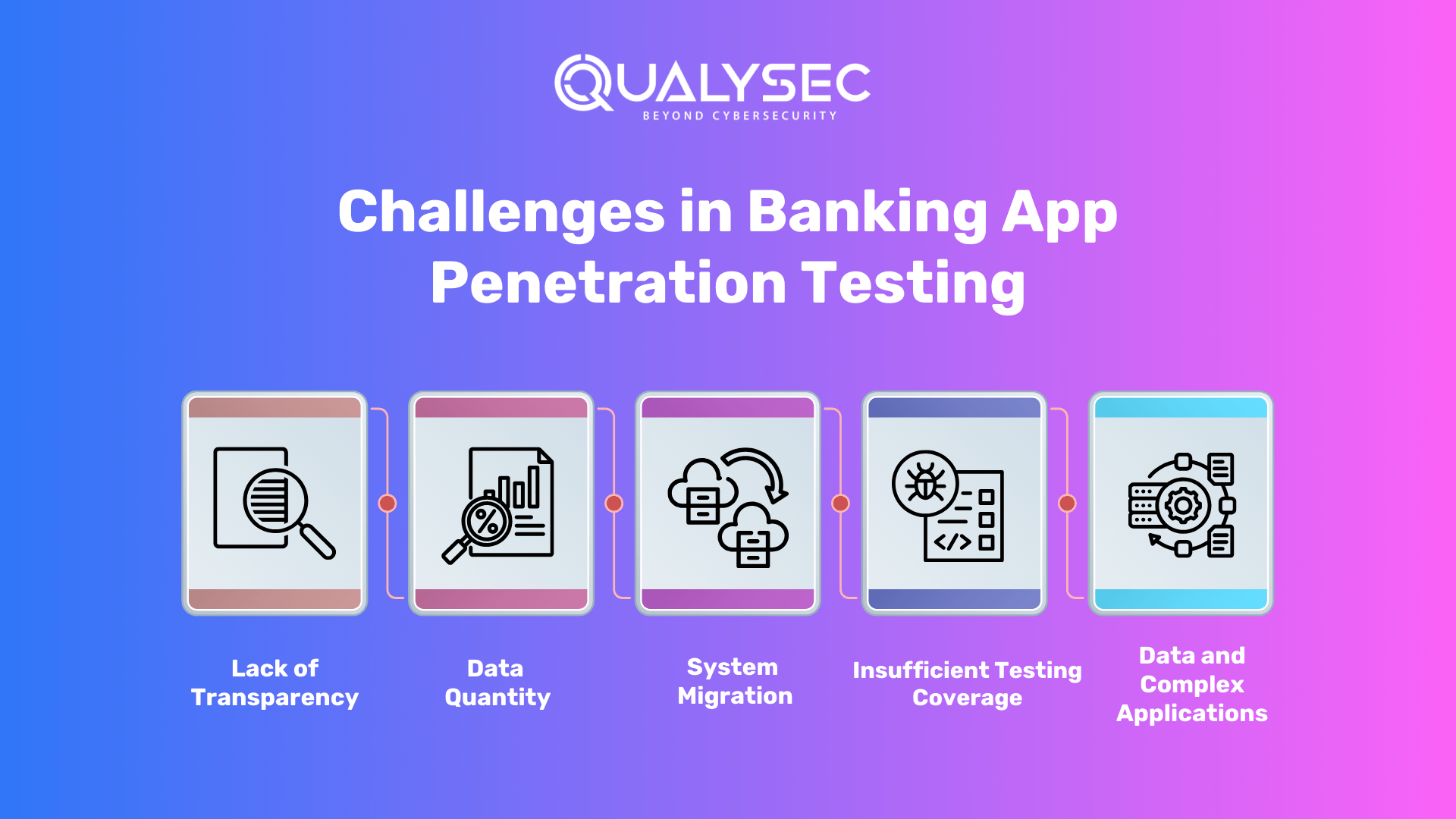

Challenges in Banking App Penetration Testing

It would be a huge undertaking to test an application that has been operating for more than 20 years. What are some of the difficulties that may arise when testing such applications? We have the following key issues while testing such applications:

- Lack of Transparency

Banks are often seen as companies governed by severe and stringent regulations. They are well aware that a flaw in their system might be disastrous. Furthermore, banks are frequently unwilling to give any information on how their systems work behind the scenes, making testing banking applications difficult.

- Data Quantity

The amount of data accessible on a daily basis is so vast that testing all of it is difficult. We must test the application for numerous situations on a certain day. A day has several data points that must be retrieved and evaluated for the application.

- System Migration

The IT sector is always evolving with new frameworks and technologies. Migrating from one system to another is a significant difficulty for the financial sector since it entails the transfer of sensitive data. To guarantee a seamless procedure, the teams should complete data migration testing and do regression testing on both systems to confirm that the data matches.

- Insufficient Testing Coverage

Inadequate testing coverage refers to insufficient testing of numerous attack vectors that hostile actors can use. This might happen because of a misunderstanding of the complete nature of the network, applications, and systems that need testing, which can lead to a false sense of security.

- Data and Complex Applications

When testing a financial application, the intricacy of the data might be challenging to address. The data is frequently so complicated that identifying the problem becomes challenging. To test complicated applications, there is no one-size-fits-all approach. However, various testing techniques might assist you.

What Steps of Pen Testing in Banking Industry?

Here are the steps that the process of penetration testing containing all the phases of how the testing is done:

- Gathering Information:

The fundamental goal of penetration testing is to obtain as much information as can. This includes a two-pronged approach: utilizing readily available information from your end, as well as utilizing numerous ways and tools to get technical and functional insights. The testing company collaborates with your team to gather critical application information. Schematics for architecture, network topologies, and any existing security measures may be provided. Understanding user roles, permissions, and data flows is critical for building an effective testing strategy.

- Planning

Cybersecurity for financial services begins the penetration testing process by meticulously defining the objectives and goals. They delve extensively into the technical and functional complexity of your application. Furthermore, this comprehensive investigation allows the testers to alter the testing strategy to address specific vulnerabilities and threats specific to your environment.

A comprehensive penetration testing plan is created, outlining the scope, methodology, and testing criteria. To lead the testing process, the business will give a high-level checklist. This checklist provides a solid foundation by addressing crucial subjects such as authentication mechanisms, data processing, and input validation.

They acquire and prepare the essential files and testing instruments. Furthermore, configuring testing settings, verifying script availability, and developing any bespoke tools required for a smooth and successful evaluation are all part of this process.

- Auto Tool Scan

During the penetration testing process, especially in a staging environment, an automated and intrusive scan is necessary. This scan comprises utilizing specialized tools to seek vulnerabilities on the application’s surface level carefully. The automated tools mimic prospective attackers by crawling through every request in the application, uncovering potential weaknesses and security gaps.

By running this intrusive scan, the testing company proactively finds and patches surface-level vulnerabilities in the staging environment, acting as a protective measure against potential assaults. This strategy provides not only a thorough review but also quick rectification, boosting the application’s security posture before it is deployed in a production environment.

- Manual Penetration Testing

Our penetration testing company offers a comprehensive selection of deep manual penetration testing services that are tailored to your specific requirements and security standards. Furthermore, this one-of-a-kind method allows for a thorough examination of potential vulnerabilities across several domains, including:

- Network Penetrating Testing: Extensive network infrastructure examination to discover and eliminate vulnerabilities, assuring the resilience of your entire network security.

- API Penetration Testing: In-depth examination of API functionality, with a focus on possible flaws and security breaches, to strengthen the robustness of your application interfaces.

- Web Applications Penetration Testing: Systematic evaluation of online applications, probing for weaknesses in authentication, data management, and other crucial areas to improve the security posture of the application.

- Mobile Apps Penetration Testing: A specialized assessment of mobile apps that identifies and addresses vulnerabilities specific to mobile settings, assuring the safe launch of your mobile applications.

- Reporting

The testing team systematically identifies and categorizes vulnerabilities discovered throughout the evaluation, ensuring that potential risks are clearly recognized. Furthermore, a senior consultant does a high-level penetration test and reviews the entire report.

This ensures the highest level of quality in testing methods as well as the accuracy of reporting. This thorough documentation is a valuable resource for understanding the security state of the application.

Key Report Components:

- Vulnerability Name: Specifies each vulnerability, such as SQL Injection, providing a precise identification.

- Likelihood, Impact, Severity: Quantifies the potential risk by assessing the likelihood, impact, and severity of each vulnerability.

- Description: Offers an overview of the vulnerability, enhancing comprehension for stakeholders.

- Consequence: Describes how each vulnerability could impact the application, emphasizing the importance of mitigation.

- Instances (URL/Place): Pinpoints the location of vulnerabilities, facilitating targeted remediation efforts.

- Step to Reproduce and POC: Provides a step-by-step guide and a Proof of Concept (POC) to validate and reproduce each vulnerability.

- Remediation: Offers actionable recommendations to effectively eliminate detected breaches, promoting a secure environment.

- CWE No.: Assigns Common Weakness Enumeration identifiers for precise classification and reference.

- OWASP TOP 10 Rank: Indicates the vulnerability’s ranking in the OWASP TOP 10, highlighting its significance in the current threat landscape.

- SANS Top 25 Rank: Indicates the vulnerability’s ranking in the SANS Top 25, further contextualizing its importance.

- Reference: Provides additional resources and references for a deeper understanding of vulnerabilities and potential remediation processes.

This comprehensive reporting method ensures that stakeholders receive relevant insights into the application’s security condition as well as practical recommendations for a solid security posture.

- Remediation Support

If the development team requires support in reproducing or reducing reported vulnerabilities, the service provider delivers a critical service through consultation calls. Penetration testers with in-depth knowledge of the discovered issues promote direct engagement to aid the development team in effectively analyzing and addressing security threats. This collaborative approach ensures that the development team receives competent advice, allowing for the seamless and speedy resolution of vulnerabilities to enhance the overall security posture of the application.

- Retesting

Following the completion of vulnerability mitigation by the development team, a vital stage of retesting happens. To check the efficacy of the treatments administered, our staff undertakes a detailed examination. The final report is lengthy and includes:

- History of Findings: This section provides a full record of vulnerabilities discovered in past assessments, providing a clear reference point for following the progress of security solutions.

- State Assessment: Clearly defines the state of each vulnerability, whether it is fixed, not addressed, or ruled out of scope, providing a comprehensive summary of the remediation outcomes.

- Proof and Screenshots: Adds physical proof and screenshots to the retest report, providing visual validation of the corrected vulnerabilities. This validates the procedure and assures a thorough and accurate assessment of the application’s security state following repair.

- LOA and Certificate

The testing company goes above and above by providing a Letter of Attestation, which is an important document. Furthermore, this letter supports facts from penetration testing and security assessments, and serves multiple purposes:

- Level of Security Confirmation: Use the letter to obtain physical certification of your organization’s security level, ensuring stakeholders of your security measures’ strength.

- Showing Stakeholders Security: Show clients and partners your dedication to security by using the letter as a visible witness to the thoroughness of your security processes.

- Fulfillment of Compliance: Address compliance needs quickly, as the Letter of Attestation is a helpful resource for satisfying regulatory criteria and establishing compliance with industry-specific security practices.

Furthermore, the testing company will provide a Security Certificate, which will enhance your ability to represent a secure environment, reinforce confidence, and meet the expectations of various stakeholders in today’s dynamic cybersecurity landscape.

How Can QualySec Help in Banking and Financial Pen Testing?

With the most powerful defenses, QualySec’s solution provides BFSI organizations with the most up-to-date technologies and comprehensive penetration testing to keep you one step ahead of intruders. In addition, we are a significant penetration testing partner that offers cutting-edge solutions to the banking, financial, and insurance industries in order for them to effectively secure themselves and their data from current and emerging cyber threats.

Our Vulnerability Assessment and Penetration Testing (VAPT) service is designed to help you find and resolve cyber security issues in your infrastructure. Our services include:

- Web App Pentesting

- Mobile App Pentesting

- API Pentesting

- Cloud Security Pentesting

- IoT Device Pentesting

- AI ML Pen testing

QualySec’s skilled penetration testers will execute a vulnerability test scan on the whole program as well as its underlying infrastructure, which includes all network devices, management systems, and other components. It’s a detailed audit that helps you find security issues so you can fix them before a hacker can.

Deep penetration testing talents, in which our professionals conduct lengthy and complex investigations to find holes in a company’s digital infrastructure, are one of our key strengths. These tests go beyond surface-level scanning to look for weaknesses deep within the system.

Important Features:

- Over 3,000 tests are utilized to detect and eradicate all types of vulnerabilities.

- Capable of detecting faults in business logic and security issues.

- Manual pen testing guarantees that no false positives occur.

- Compliance scans for SOC2, HIPAA, ISO 27001, and other related standards.

- On-demand remedial assistance is provided by security specialists.

Our unwavering commitment to truth has earned us an incredible zero-false positive report record. Following extensive testing, we provide clients with a detailed and informative report that properly identifies weaknesses and potential exploits.

We go above and beyond by collaborating with developers to assist them in the bug-fixing process, ensuring that reported vulnerabilities are fixed as soon as possible. Businesses receive a security certificate at the end of a project as a final stamp of approval, establishing trust in our cybersecurity procedures and strengthening their defenses against potential threats.

Latest Penetration Testing Report

Conclusion

Security testing and penetration testing uncover all of the threats that the apps may encounter. Ascertain that application risks are reduced and that benchmarks for your software code are suitably configured for enhanced quality assurance.

At QualySec, we provide cybersecurity for financial services tailored to your specific company needs. Furthermore, our team of professionals specializes in doing extensive testing across a wide range of sectors, identifying and fixing complex vulnerabilities in the business infrastructure, wireless networks, online and mobile apps, network settings, and more.

Beyond testing, we provide extensive post-test care, actionable insights, targeted remedial help, and a strategic security council. We devote to supporting you in improving your cyber security posture over time. To get started, contact us now!

FAQs

Why is cybersecurity important in financial services?

The major purpose of cybersecurity in banking is to protect the user’s assets. Additional activities or transactions are moving online as more individuals abandon cash. People perform transactions using digital payment methods such as debit and credit cards, which must be secure.

Why is security important in the banking industry?

Banks must prioritize cyber security in order to keep their clients’ money safe and secure. Cybersecurity also contributes to the preservation of client trust and confidence in the financial sector. Banks employ cutting-edge security procedures to safeguard their clients’ personal information and financial activities.

What type of security is used in banks?

A security is a financial instrument or financial asset that may be exchanged on the open market, such as a stock, bond, options contract, or mutual fund share. Debt securities, equity securities, derivative securities, and hybrid securities (a mix of debt and equity) are the four primary forms of security.

Why is Security Testing crucial for the Banking and Financial Services sector?

Cybercriminals are always seeking system flaws to exploit and steal sensitive information such as personal and financial information. To prevent such assaults, financial organizations must undertake frequent penetration testing on their IT infrastructure and data.

What is the role of Penetration Testing in the Financial Industry?

A complete security approach for the banking and financial business must include penetration testing. It aids in the detection of vulnerabilities, the testing of security measures, and the monitoring of emerging threats, eventually assisting in the protection of sensitive data and the preservation of an organization’s reputation and consumer confidence.

How often should a financial institution conduct Security and Penetration Testing?

Penetration testing should be conducted on a regular (at least once a year) basis to guarantee more consistent IT and network security management by disclosing how newly found threats (0-days, 1-days) or growing vulnerabilities might be exploited by malevolent hackers.

What are the common security challenges faced by the Financial Industry today?

Some of the major challenges faced by the financial industry are data theft, phishing, ransom, spoofing attacks, etc. The finance industry is taking a major shift to overcome these challenges are protect their customers and business infrastructure.

0 Comments