Dubai International Financial Centre (DIFC) has a comprehensive legal framework, called the Data Protection Law (DPL) to protect the privacy of personal user data in websites and applications. This law states that the apps under the DIFC should conduct regular audits to ensure security. Since penetration testing is critical to security audits, it has become mandatory for app manufacturers. Penetration testing in DIFC identifies and mitigates vulnerabilities, ensuring the integrity and confidentiality of sensitive data. By complying with these regulations, businesses enhance their cybersecurity and build client trust.

DIFC collects information when users access their websites, use their email addresses, or use any of their web-based services, like their public Wi-Fi. They even collect data through interactions and communications, such as with their DIFC Connect App.

The DIFC Online Data Protection Policy values the privacy and security of user data. The policy outlines how the data collected from the websites and apps are kept secure from possible breaches. For the most part, the policy includes conducting regular security audits and adhering to the industry’s best practices to keep the data secure.

What is the Data Protection Policy and Regulation for DIFC?

When you use any of the DIFC services, be it websites or apps, you are acknowledging the practices described in this policy.

1. Scope and Application

This policy applies to anyone globally who uses DIF websites or apps.

2. Collection of Information

- Information you provide: This includes personal data you give through forms, correspondence, or registration. It may include your name, email, address, phone number, etc.

- Automatically Collected Information: This includes the technical details about the device you are accessing, usage details, and location data if GPS is used.

3. Use of Personal Data

DIFC uses your data to:

- Provide and improve services

- Perform administrative tasks and prevent online fraud

- Communicate with you about services and updates

- Ensure security and compliance with relevant laws

4. Processing, Storage, and Transfer of Data

The policy states that your given data is lawfully processed, securely stored, and may be transferred within the UAE and other countries for DIFC operations.

Consider penetration testing services in UAE for enhanced cybersecurity.

5. Sharing of Personal Data

DIFC may share your data with third-party entities for services, legal requirements, and business operations. This may include government authorities and service providers.

6. Your Rights and Choices

You have the option to remain out of marketing communications, access, correct, or delete your personal data. Additionally, the data protection policy lets you adjust your data preferences.

7. Security Precautions

DIFC implements strong security measures to protect your data. However, it cannot guarantee 100% security for transmitted online.

8. Cookies

DIFC uses cookies to improve user experience. You manage your cookie preferences in your browser settings.

7. External Links

DIFC is not responsible and shall not be liable for any loss or damage that results from using the third-party websites linked to their website’s services or apps.

8. Building Security

DIFC maintains all the necessary security records for visitors. Additionally, it is not responsible for any personal or business content theft in its buildings after the tenant vacates.

9. Policy Changes

This data protection policy may change and DIFC will notify its users when it does. Users are therefore encouraged to review the new policies at their given time.

DIFC Data Protection Security Measures

DIFC ensures all personal data is secure in its system with the best security measures. It has a dedicated staff to maintain the data protection and security policies, regularly reviewing them. However, no protection measure can guarantee 100% safety for data transmitted over the internet. As a result, DIFC cannot warrant or guarantee the security of data transmitted to them via the Internet.

The steps taken by DIFC data protection guidance to protect personal data include:

- Establishing policies to securely manage user information.

- Limiting user access to sensitive data so that they view only necessary information to perform his/her duties.

- Using security measures like data encryption, authentication, and virus detection technology to protect personal data against unauthorized access.

- Conducting employee background checks and providing security awareness and training to them.

- Monitoring websites through recognized online privacy and security organizations.

- Conducting regular third-party security audits (that includes penetration testing in DIFC).

Importance of Penetration Testing in DIFC Data Protection Policy

Penetration testing is a vital part of security audits and Dubai International Financial Centre (DIFC) policy clearly states that it performs regular audits. Hence, penetration testing is indirectly a crucial step in protecting personal data.

Penetration testing is a cybersecurity process where the testers (also called “ethical hackers”) simulate real attacks on the apps to check the efficiency of existing security measures. The process helps in identifying security vulnerabilities that hackers could exploit for unauthorized access and data breaches.

Here’s how penetration testing in DIFC helps secure data online:

1. Identifies and Fixes Security Vulnerabilities

Penetration testing actively tries to identify and exploit different types of vulnerabilities in systems, applications, and networks. By detecting them before attackers, DIFC can address and fix those issues promptly. In fact, the pen test report includes the vulnerabilities found during the test, their impact level, and steps to fix them. This ensures that the app or website is vulnerability-free and is less prone to data breaches.

Want to see a real pen test report and how it helps developers fix security issues? Click the link below!

Latest Penetration Testing Report

2. Ensures Apps are Safe from Cyber Threats

Through regular penetration testing, DIFC can check the effectiveness of their security measures by simulating real-world cyberattacks. This ensures all the security protocols are up-to-date and continuously protect the data against evolving cyber threats.

3. Maintains High-Security Standards

DIFC is known for its high security standards and penetration testing helps maintain them. By routinely testing and improving the security measures, DIFC showcases its dedication to protecting personal user data and maintaining its trust. Additionally, this ongoing testing process is critical in securing sensitive information from unauthorized access.

4. Supports Compliance with Data Protection Regulations

Penetration testing plays a key role in helping DIFC comply with various data protection regulations and industry standards like SOC 2 and ISO 27001. These standards make it mandatory for applications and websites to perform regular security audits. Those who store and manage user data are entitled to comply with these regulations, or else face legal penalties and fines.

How Qualysec Can Help DIFC with Penetration Testing/Security Audits

Qualysec Technologies is a leading penetration testing service provider in Dubai and the entire UAE. Since our foundation, we have completed over 450 assessments for over 110 clients worldwide. Additionally, till now we have not received a single data breach case from any of our clients.

We have a highly skilled team of ethical hackers who are trained with the latest and advanced tools and techniques. As a result, this gives us the edge to provide customized pen testing solutions to our partners. From startups to Fortune 500s, we have provided security audits and secured applications for an array of companies.

To go into further detail, here are a few ways how we can help the DIFC with penetration testing and security audits:

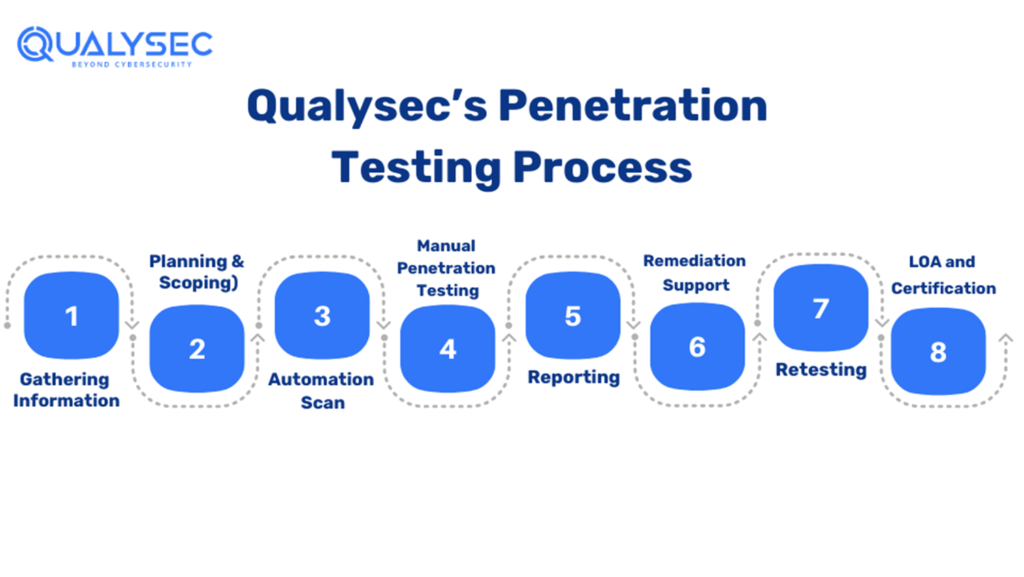

1. Comprehensive Hybrid Testing

We offer thorough penetration testing services for web, mobile, and cloud applications. We use a process-based hybrid pen testing approach where we use both automated tools and manual testing techniques to ensure no security flaws are overlooked.

2. Detailed Reporting

After conducting the tests, we document all the findings in a detailed report. It includes the vulnerabilities found, their potential impact, and actionable recommendations to address these risks. This can help the DIFC understand and mitigate security weaknesses effectively.

3. Post-Assessment Support

We not only test your applications to find vulnerabilities, but we retest them to confirm there are no remaining vulnerabilities. Additionally, we offer continuous support throughout and even after the testing process. We help your development team locate the vulnerabilities we found along with their remediation steps. This ongoing assistance will ensure the apps remain secure over time.

Want to conduct penetration testing in DIFC or security audits for your applications? Click the link below and talk to our cybersecurity experts!

Talk to our Cybersecurity Expert to discuss your specific needs and how we can help your business.

Conclusion

Dubai International Financial Centre (DIFC), the leading global financial center in the Middle East, Africa, and South Asia (MEASA) region, has strong data protection policies. These policies mandate regular security audits to ensure user data is safe from cyber threats. Since penetration testing in DIFC is a crucial part of security audits, it becomes essential to secure data.

By simulating real-world cyberattacks, penetration testing ensures that DIFC’s apps and websites are resilient against growing cyberattacks. This proactive approach not only protects user information but also ensures compliance with industry standards and trust among stakeholders. Directly or indirectly, penetration testing has become an integral part of the DIFC data protection policy. Consider penetration testing companies in Dubai to strengthen cybersecurity measures further.

FAQs

Q: What is the DIFC data protection law?

A: The DIFC data protection law enacted by the Dubai International Financial Centre (DIFC) includes regulations aimed at protecting user data in their apps and websites. Additionally, it includes rules regarding secure collection, processing, storage, and transfer of personal data.

Q: Does DIFC need penetration testing?

A: Yes. DIFC’s data security policies involve conducting regular security audits to find and fix security weaknesses that may lead to data breaches. As penetration testing is the most effective way to carry out this task, it is very important for DIFC.

Q: How does penetration testing protect user data?

A: Penetration testing helps uncover security weak points that attackers may use for data breaches. Before hackers hack your application, you hack your own app to detect where the vulnerabilities are. As a result, you can implement the necessary changes (like encryption and access controls) to enhance your data security.

0 Comments