For those not familiar with the PCI DSS standard, the Payment Card Industry Data Security Standard (PCI DSS) was developed to enforce the security of cardholder data. If you are in the business of handling credit cards or any other payment information of users, you need to comply with PCI regulations to avoid legal problems and fines. The best way to comply is by conducting PCI penetration testing.

Organizations could be fined up to $100,000 per month if they have been non-compliant for a while.

Penetration testing is a method where cybersecurity specialists simulate real attacks to detect and exploit vulnerabilities that could give cybercriminals unauthorized access to user information. The regulatory bodies mandate organizations to regularly conduct PCI penetration testing to secure payment card information.

In this blog, we will explain what exactly PCI penetration testing is, what are its requirements, and which company you should choose to conduct the test. Stay tuned!

What is PCI Penetration Testing?

PCI penetration testing or PCI DSS penetration testing is an exercise where an organization (that handles credit card info) hires a third-party firm to check whether its IT environment is safe from cyberattacks.

A PCI penetration test specifically evaluates the following:

- Security of your cardholder data environment

- Any networks or systems connected to your cardholder data environment

- Isolated systems or networks that connect your internal infrastructure and apps to external systems, on public networks.

PCI penetration testing is required to maintain PCI DSS compliance. Non-compliance can lead to legal penalties and even loss of payment card processing privileges.

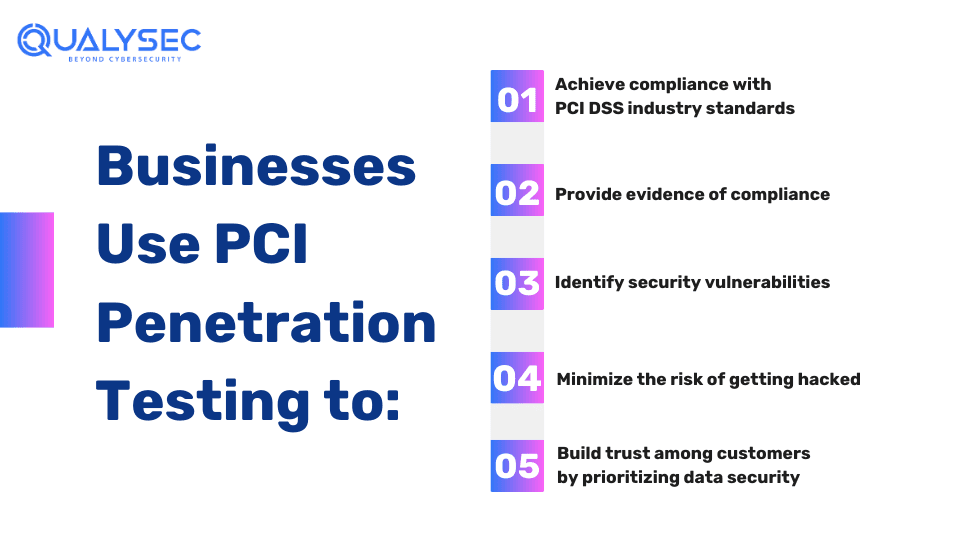

Importance of PCI Penetration Testing

Credit card fraud is one of the most common issues that affects millions of cardholders across the globe, especially in the US. If your business deals with cardholder data, a protective card environment should be a top priority in your security.

As per the PCI Security Standards Council, the main goal of penetration testing is to determine whether and how cybercriminals can gain unauthorized access to files, logs, and cardholder data. Additionally, it confirms that the organization implements the necessary security controls outlined by PCI DSS.

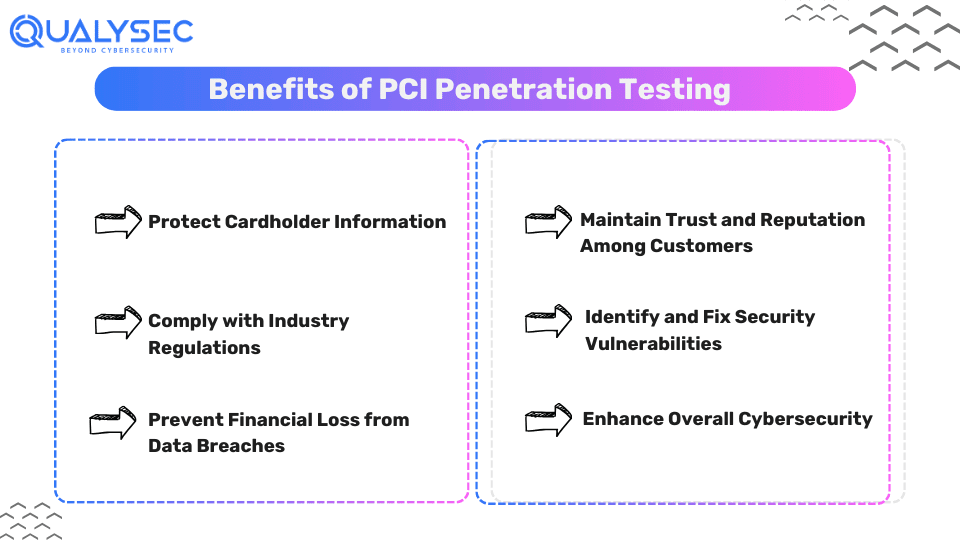

Benefits of Conducting PCI Penetration Testing

1. Protect Cardholder Information

By conducting PCI penetration testing, you ensure the security of the system storing and processing customer’s payment data from unauthorized access. This protects their credit card details, personal information, and other sensitive data from falling into the hands of cybercriminals.

2. Comply with Industry Regulations

PCI penetration testing is often required to comply with industry regulations and standards, such as the Payment Card Industry Data Security Standard (PCI DSS). By meeting these requirements, you avoid legal penalties and maintain the ability to process credit card payments securely.

3. Prevent Financial Loss from Data Breaches

By identifying and fixing vulnerabilities through PCI penetration testing, you decrease the chances of successful cyberattacks. This reduces the risk of financial losses associated with data breaches, such as fines, legal fees, and compensation payouts to affected customers.

4. Maintain Trust and Reputation Among Customers

Showing your commitment to the security of customer data through regular PCI penetration testing helps maintain trust and confidence in your business. Customers are more likely to choose and continue doing business with organizations that keep their private information safe.

5. Identify and Fix Security Vulnerabilities

PCI penetration testing helps uncover security weaknesses in your systems and applications that could be exploited by cyber attackers. The PCI penetration testing report will also include how to fix those weaknesses. As a result, you can prevent a significant amount of cyberattacks on your business.

6. Enhance your Overall Cybersecurity

By regularly testing for compliance with PCI standards, you improve your organization’s overall cybersecurity posture. This helps protect your applications, networks, and other digital assets from a wide range of cyber threats, not just from those related to payment card information.

PCI Penetration Testing Requirements

PCI DSS requirement 11 contains control measures related to establishing a vulnerability management process. These controls include quarterly internal and external vulnerability scans and annual penetration tests.

PCI DSS requirement 11.3 specifically addresses penetration testing, whose requirements include:

- Who Performs PCI penetration Testing: Either an experienced internal resource of an external cybersecurity firm.

- Scope: Critical systems and any networks or systems linked to where cardholder data is stored.

- Frequency: PCI penetration testing should be performed at least once a year or after any major changes. Service providers should perform pen tests semi-annually.

- Methodology: A clear methodology should be defined, which includes scope, documentation, and rules of engagement. The testing methodology should follow industry standards and PCI guidelines.

- Testing Components: It includes segmentation control, network, and application layer testing, coverage for CDE and critical systems, etc.

- Test Report and Documentation: The summary and results of the PCI pen test should be documented. The report must include the vulnerabilities found, their impact level, and remediation methods.

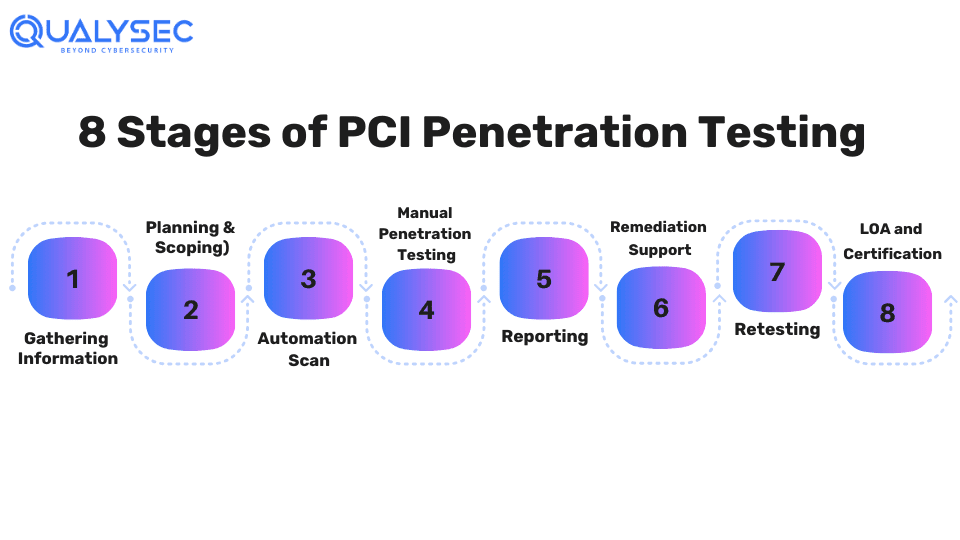

Stages of PCI Penetration Testing

The PCI penetration testing process involves several steps that need to be followed in a specific order. Here are the PCI pen test stages:

1. Information Gathering

The first step of PCI penetration testing is to gather as much information about the application or network that is being tested. Either the organization can provide the necessary information, or the pen testers gather information from publicly available web pages.

2. Planning and Scoping

The organizations then work with the pentesting team to define the scope of the test. This includes the entire CDE perimeter (both internal and external), and any vital systems. It may also include critical network connections, access points, and applications that store, process, or transmit cardholder data.

3. Automated Vulnerability Scans

The pen testers use various automated vulnerability scanners, for example, Burp Suite, Netsparker, OWASP ZAP, Metasploit, etc. It is a quick method to find surface-level vulnerabilities in applications and networks.

4. Manual Penetration Testing

This is where the real PCI penetration testing takes place. Here, the pen testers manually simulate real cyberattacks on the tested environment to identify and exploit vulnerabilities. Since it is done manually, organizations can get a deeper level of assessment of their digital assets.

5. Reporting

All the vulnerabilities found during the pen tests are documented. Additionally, the pen test report includes the potential impact of each vulnerability, along with remediation methods.

6. Remediation

The development team then uses this report to fix all the vulnerabilities found during the testing. If needed, the pen testing team will help them over consultation calls.

7. Retest

After the development team has completed fixing, the testing team will retest the application to check whether all vulnerabilities are properly eliminated.

8. LOA and Security Certificate

The penetration testing company will then issue a letter of attestation (LOA) and a security certificate, which proves that you have successfully conducted a penetration test. Organizations show this certificate to comply with the PCI DSS regulations.

Curious to see what a real PCI penetration test report looks like? Here’s your chance. Click the link below and download one right now!

Latest Penetration Testing Report

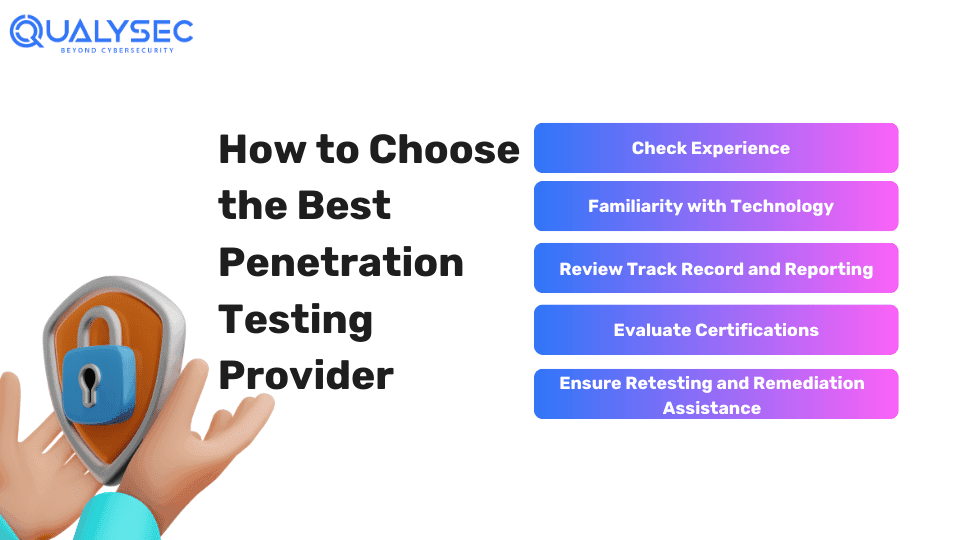

How to Choose the Right PCI Penetration Testing Provider

A qualified external party should perform PCI DSS penetration testing. With so many options, it can be overwhelming to choose the right one. So, here we have mentioned a few factors that need to be considered while choosing the right PCI penetration testing service provider:

1. Check Experience

Check how many years of experience the penetration testing company has. You should also pay attention to industry-specific experience, for example, e-commerce, hospitality, healthcare, etc. While new companies can still perform accurate pen tests, it is better to choose someone with some relevant experience.

2. Familiarity with Technology

Is the penetration testing team familiar with the latest tools and technology that are needed during the test? Check whether the testing team is up to date with the latest vulnerabilities and automated tools.

3. Review Track Record and Reporting

Check whether the testing company has a good track record of conducting pen tests. You can ask them for some references from other clients they have worked with. Additionally, you can ask for a sample pentest report to check whether their documentation matches your needs.

4. Evaluate Certifications

A list of industry-approved certifications held by the pen testers is also a huge advantage when choosing a service provider. Some of the common penetration testing certifications include OSCP, CEH, CISSAP, CompTIA PenTest+, etc.

5. Ensure Retesting and Remediation Assistance

Before you choose a PCI pentest company, check whether they provide retest options. Retesting an application guarantees that it is free from vulnerabilities. Additionally, ask whether they would likely help your development team with remediation.

Why Qualysec Stands Out as a Trusted PCI Penetration Testing Provider

With extensive experience in cybersecurity solutions, Qualysec Technology is a trusted penetration testing provider of many top brands in the world (for example, Konica Minolta, OneSheild, and CloudBolt). We are one of the few companies in the world that follow a process-based, industry-specific methodology.

With our thorough assessments, we help you identify vulnerabilities in critical systems and networks connected to cardholder data environments.

What sets us apart is our clear and comprehensive reporting. Along with the vulnerabilities, we also document the severity of their impact and steps to fix them. We prioritize open communication and ensure clients get all the help they need with remediation and security certificates.

With Qualysec, you can trust our expertise to secure sensitive payment card data and maintain compliance with PCI standards.

Want to Comply with PCI DSS regulations? Choose Qualysec for the best PCI penetration testing services. We follow a hybrid method of pen testing that will help you meet industry standards and enhance your overall security posture. Don’t wait! Contact now!

Talk to our Cybersecurity Expert to discuss your specific needs and how we can help your business.

Conclusion

Maintaining PCI DSS compliance is necessary if your business deals with customer’s credit card data. Furthermore, cybercriminals primarily target confidential data (like payment information). This is why regularly performing PCI penetration testing should be a top priority for organizations.

You need to carry out your annual PCI penetration tests for continuous compliance. However, you don’t need to carry the load of achieving and maintaining PCI DSS certification on your own. With Qualysec, you can confidently secure sensitive payment card data and maintain compliance with PCI standards, as well as secure your reputation and customer trust.

FAQs

Q: What are the 3 types of PCI Penetration Testing?

A: The 3 types of PCI penetration testing are divided based on the information provided:

- Black Box penetration test: The testers have no information about the tested environment

- White Box penetration test: The testers have all the information about the tested environment

- Grey Box penetration test: The testers have limited information about the tested environment

Q: What does the PCI Test stand for?

A: PCI stands for “Payment Card Industry”. PCI test is done to protect the confidential credit card data of the users.

Q: Who needs PCI penetration testing?

A: If you are a business or payment service provider (PSP) that stores, handles, processes, or transmits card payment data, you must maintain PCI DSS compliance by conducting annual PCI penetration testing.

Q: Who conducts PCI penetration testing?

A: Typically, a third-party penetration testing service provider or an external cybersecurity firm conducts PCI penetration testing.

![Top 20 Network Security Companies in USA [2025 Updated List]](https://qualysec.com/wp-content/uploads/2025/05/Top-20-Network-Security-Companies-in-USA-2025-Updated-List-scaled.jpg)

0 Comments