Credit card payments, housing loans, and industrial credit in India are growing at double-digit rates. As this rapid expansion has come, the need to protect sensitive credit information is more urgent than ever.

To fulfill this need, the Government enacted the Credit Information Companies (Regulation) Act, 2005 (CICRA), creating a strong legal and regulatory framework for the operationalization of CIC, credit institutions, and other specified users. Not only is CICRA compliance a statutory obligation, but it also constitutes a very important move towards protecting consumer trust and the reputation of the institution itself.

Penetration testing for CICRA compliance is among the best tools for ensuring that CICRA’s requirements are met. Qualysec Technologies is here to explain why penetration testing is required to attain CICRA compliance, the regulatory requirements, and also indicate how we can help your business acquire and maintain compliance.

Understanding CICRA Compliance

What is CICRA?

CICRA stands for the Credit Information Companies (Regulation) Act, 2005. The Government of India introduced CICRA to regulate the functioning of data collection, maintenance, and dissemination of credit information. Comprehensive guidelines have been laid under both the Act and the Credit Information Companies Rules and Regulations of 2006 for –

- Registration and licensing of CICs

- Data privacy and protection

- Security measures for credit information

- Audit and compliance requirements

- Penalties for non-compliance

All organizations involved in handling credit information, i.e., banks, NBFCs, and other financial institutions, have to be CICRA compliant. These regulations are enforced by the Reserve Bank of India (RBI)

Why is CICRA Important?

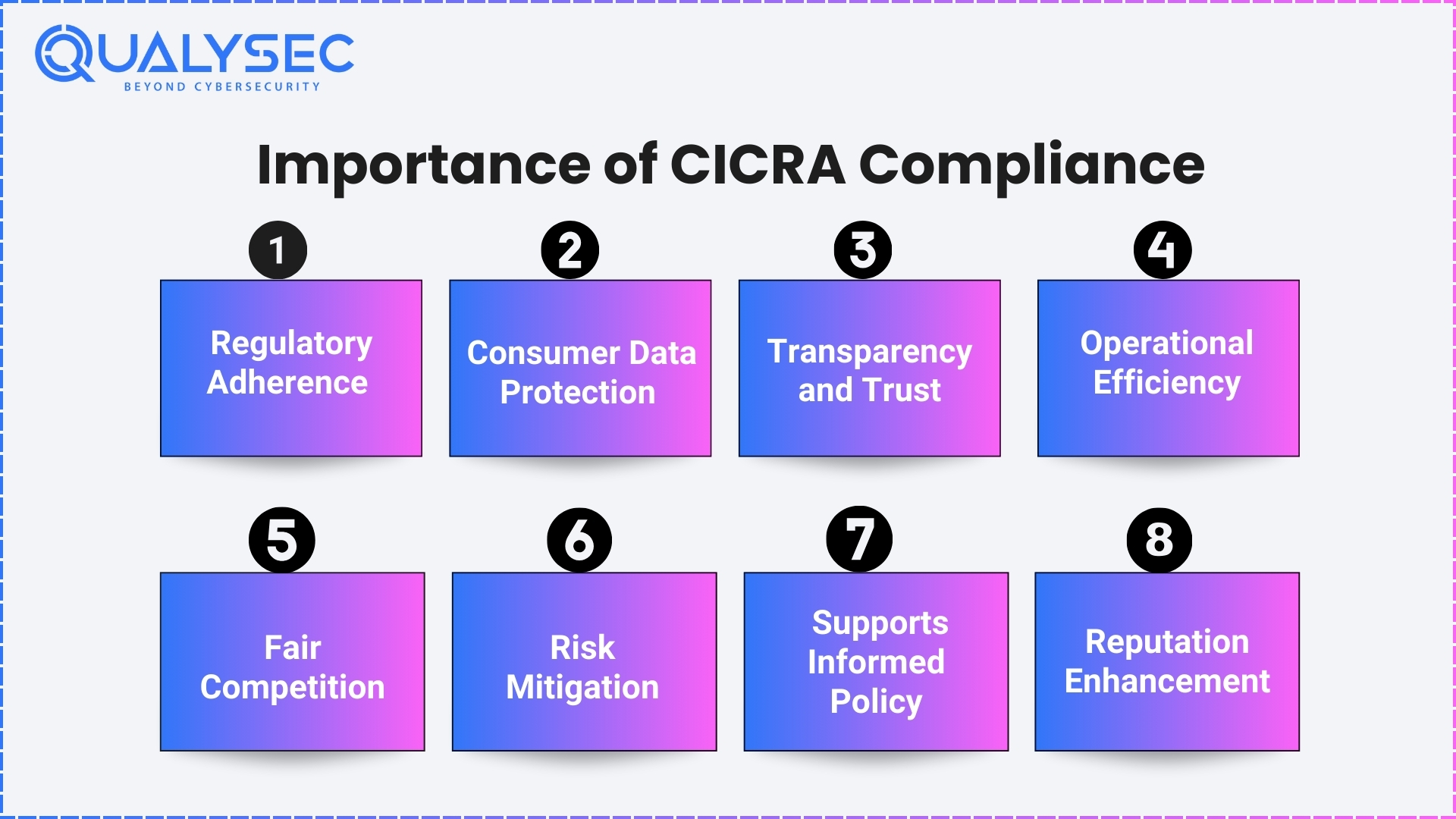

- Regulatory Adherence – It also helps prevent organizations handling credit details from getting any kind of legal penalty, fines, or suspension of their operations under the Credit Information Companies (Regulation) Act, 2005.

- Consumer Data Protection – It’s able to safeguard consumer credit data that’s sensitive since it will reduce data breach risks, fraud, and ensure fair pricing and secure service delivery.

- Transparency and Trust – Provides transparency in handling credit information, building trust with the customer, partner, and ongoing regulatory obligations with transparent data management.

- Operational Efficiency – It finds where there is a lack of data handling and security processes. It can be used to save costs and provide a more efficient and reliable data delivery service.

- Fair Competition – It helps to create a level playing field to guarantee that every credit institute and the user deal with the same standards, thus helping in healthy competition within the world of finance.

- Risk Mitigation – It helps in the detection and addressing of potential fraud, mismanagement, and other operational risks before such issues escalate to their most dangerous level, thereby protecting organisations and consumers.

- Supports Informed Policy – Regulators can make use of the insights from audits to improve guidelines published to the industry and to enhance the credit ecosystem.

- Reputation Enhancement – It shows the organization’s commitment to maintaining compliance and security, and improves the organization’s image and credibility in the market.

The Role of Penetration Testing for CICRA Compliance

What is Penetration Testing?

Pen testing, also known as penetration testing, is a simulated cyber attack conducted by security professionals to uncover vulnerabilities in an organization’s digital infrastructure. Penetration testing is different from an automated vulnerability scan because the pen tests will involve manual techniques and creative attack strategies, just like how attackers perform their attacks in the real world.

Key Objectives of Penetration Testing:

- Find such vulnerabilities before attackers.

- Checks how existing security systems are effective.

- Provide actionable recommendations for remediation

- Ensure compliance with regulatory standards

What Does Compliance Require of Penetration Testing?

CICRA mandates robust data protection, privacy, and security controls for all entities handling credit information. In several ways, Penetration testing for CICRA compliance can be instrumental for these requirements:

Assessing Data Handling Practices

Organisations need to follow strict data protection measures mandated by CICRA compliance. Penetration testing will make sure sensitive credit information is properly protected when it is collected, stored, processed, and transmitted. In the test phase, the exploits try to find the flaws in data flow, encryption, and access controls to make sure that data is not shown to unauthorized users.

Validating Security Controls

As a result, CICRA and the associated rule require technical and organizational controls in order to prevent data breaches and unauthorized disclosure. The controls, including things such as firewalls, intrusion detection systems, and authentication mechanisms, are rigorously challenged through penetration testing to determine whether they withstand such attacks.

Complying with Auditors and Regulators

A penetration testing report from a company like Qualysec is a sound proof of proactive security measures that can be used as documented evidence. Based on these reports, vulnerabilities, severity, and remediation steps are critical during CICRA audit and RBI-appointed auditors’ inspections.

Continuous Security Improvement

Compliance with CICRA is not a one-time phenomenon but a process that might continue indefinitely. The more regular penetration testing, the better it allows an organization to stay ahead of ever-changing threats, evolve with technology, and ensure there is a good security posture by meeting regulatory expectations.

Reduction of Regulatory Penalties Risk

Penetration testing identifies and abates the vulnerabilities prior to them being exploited. This prevents financial and credit damage resulting from the breach and regulatory sanctions.

Need help with CICRA compliance? Get a free consultation with our experts today!

Talk to our Cybersecurity Expert to discuss your specific needs and how we can help your business.

Qualysec’s Approach to Penetration Testing for CICRA Compliance

Testing for security has to be rigorous, methodical, and transparent. A trusted partner to those companies looking to satisfy CICRA requirements, expert-led penetration testing is one of the key services provided by Qualysec Technologies. Qualysec’s approach guarantees that your business remains compliant and secure in this manner.

Process-Based, Industry-Standard Methodology

- Global Standards Alignment – Qualysec adheres to the Global standards. That way, we make sure every penetration test will meet the stringent rigors requested by the regulators and accepted in all jurisdictions.

- Qualysec Approach – Taking the Hybrid Testing approach of combining automated tools with manual testing, hence able to provide a deep and effective security assessment even for those vulnerabilities that automated scans cannot detect well enough.

Comprehensive Scoping and Planning

- Scoping – Qualysec, due to its close working relationship with clients, tailors the scope solidly to cover those critical assets, applications, and networks that handle credit information as necessary according to the CICRA.

- Definition – Identifying return on investment (ROI), types of clients, engagement processes, and communication strategies.

Transparent and Collaborative Testing

- Transparency – Qualysec provides us with open communication, starting from testing and interacting with client teams to keep them updated about what is going on at every stage.

- Collaboration – Get up-to-date information on findings, so remedial actions can be taken quickly and business disruption is reduced.

Rigorous Quality Assurance

- Real Methods – As part of its penetration tests, Qualysec’s tests span various network, application, and infrastructure layers, mirroring real attack scenarios in order to find vulnerabilities in the whole environment.

- Strict Quality Control – All the findings undergo a special review, where all aspects are checked to ensure accuracy, as well as reliability for robust governance, risk, and compliance (GRC) validation.

Detailed Reporting and Remediation Guidance

- Comprehensive Reports – Give you clear, actionable reports that categorize vulnerabilities based on severity (critical, high, medium, low, minimal) using global standards. Both the technical team and the auditors will find these reports to supply technical details, business impact, and remediation steps on what can be done about it.

- Support – Reporting alone is not sufficient to address vulnerabilities or to improve your security posture. Hence, we provide remediation support. Qualysec brings with it expert guidance to organizations to do so.

- Fast-Track Journey – Qualysec helps organizations comply faster without sacrificing quality or thoroughness.

Latest Penetration Testing Report

Conclusion

Trust and security in India’s credit information landscape are a question of compliance. As the size of the transactions in the credit space increases, it increases the risks of data breaches and regulatory scrutiny. Penetration testing for CICRA compliance is not a technical thing, it’s a strategic imperative. Now is exactly the right time for you to add penetration testing to your list of the key pillars driving CICRA compliance for your organization if you handle credit information. Protect your business, achieve compliance with Qualysec Technologies. Contact us today!

Frequently Asked Questions

1. Is there a requirement for penetration testing to fulfill CICRA compliance?

While CICRA does not explicitly mandate penetration testing, it requires robust data security practices. Regular penetration testing is widely recognized as a best practice to demonstrate compliance.

2. What is the frequency of penetration testing to fulfill CICRA requirements?

Penetration testing should be performed on a best practice basis, which can be annually or after a significant change in your systems, applications, and infrastructure. It is also periodic testing that shall identify the new vulnerabilities and act on them quickly.

3. What types of penetration testing are most ‘CICRA’ related?

Most critical is network and web application penetration testing since these environments normally handle sensitive credit information. Based on organizational risk assessment, social engineering and physical security tests may also be relevant.

4. What is the relationship between Penetration testing for CICRA compliance?

Technical validation of security controls is offered by penetration testing, and the resulting documentation can be submitted during CICRA audits. It offers proactive risk management and contributes to an audit finding with empirical evidence.

0 Comments