European Union Digital Finance Strategy is an overarching policy for supporting the financial system to become digitalized and upgraded in a way that also sustains the security, resilience, and protection of consumers. Given the fact that financial services rely more and more on digital infrastructures, it is understood in the EU the importance of taking a common policy on regulation concerning cyber attacks as well as operational risk. This article discusses where DORA compliance sits within the broader EU Digital Finance Strategy, how it impacts financial institutions, and the potential future for digital finance in the region.

One of the most important regulations backing this approach is the Digital Operational Resilience Act (DORA), which requires a strong cybersecurity and resilience culture within financial institutions. By ensuring strong IT governance, aligned risk management practice, and enhanced incident response, DORA aims to make the financial system resilient to the disruption that may arise due to cyberattacks, operational problems, and third-party reliance.

Understanding the EU’s Digital Finance Strategy

The EU’s Digital Finance Strategy, adopted in 2020, is a strategy for accelerating the digitalization of finance in a manner that promotes the stability and security of digital financial services. It has four priorities:

1. Promoting Digital Innovation

The approach promotes the application of new financial technologies (FinTech) to improve service delivery, efficiency, and accessibility. By promoting regulatory sandboxes and pilot projects, the EU aims to facilitate responsible innovation in technologies such as artificial intelligence (AI), blockchain, and digital payments.

2. Encouraging a Competitive Market

To ensure a level playing field, the EU promotes level competition among incumbent financial institutions and new FinTech entrants. The strategy aims at eliminating regulatory barriers to enable it to be simple to offer cross-border financial services with confidence that they meet EU financial rules.

3. Financial Stability and Cybersecurity Improvements

With increased digitized financial services, operational risks including IT system collapse, cyber threats, and breaches of data reign supreme on the list. The approach is building operational resilience to enable financial institutions to absorb and recover from interruptions.

DORA indirectly supports this pillar through the imposition of a uniformed IT risk management framework, expecting regular resilience testing, and burdening best practices in cybersecurity on financial institutions and their third-party service providers.

4. Promote Consumer Protection and Inclusion

Among the top priority matters is making digital financial services accessible, transparent, and safe for consumers overall. The EU strategy places focus on strong data protection, fair credit, and access to financial literacy to empower consumers in the digital economy.

By integrating DORA into the Digital Finance Strategy as a whole, the EU aims to achieve a balance of consumer confidence, innovation, market competitiveness, and resilience in the course of ultimately building an efficient and safe digital financial system.

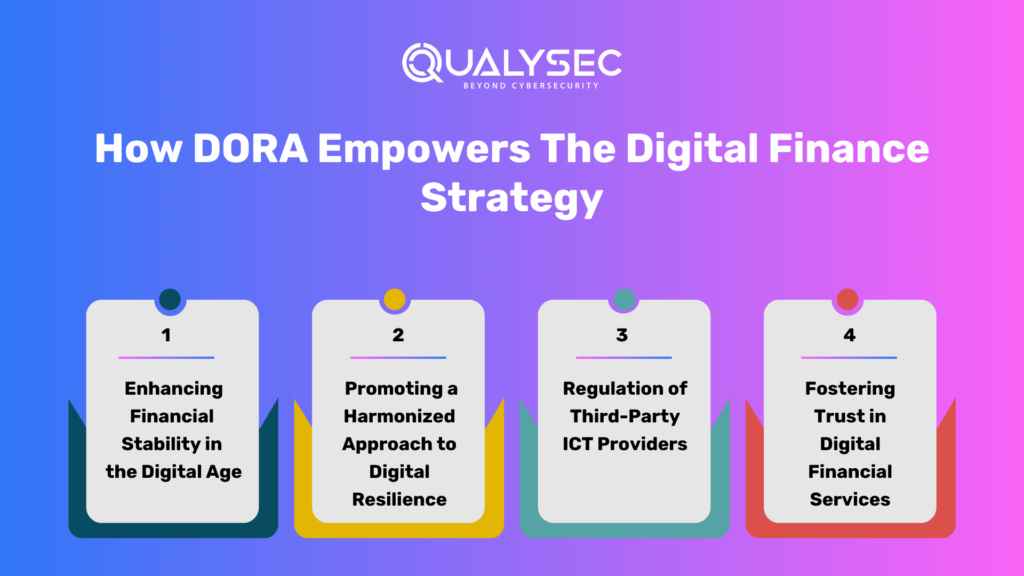

How DORA Empowers the Digital Finance Strategy

1. Enhancing Financial Stability in the Digital Age

Since banks are becoming more digital in their services, they expose themselves to increased cyber vulnerabilities. DORA requires risk management and resiliency planning to be part of the operational models of such banks, reducing the risk of financial instability driven by the cyber environment.

2. Promoting a Harmonized Approach to Digital Resilience

EU member states previously had diverse national requirements for the financial sector’s cybersecurity. DORA unifies regional resilience measures to promote uniformity in managing risk and compliance.

3. Regulation of Third-Party ICT Providers

The majority of financial institutions rely on third-party ICT providers to supply cloud computing, data analytics, and cybersecurity services. DORA establishes oversight mechanisms to oversee and monitor these providers and ensure they meet security best practices.

4. Fostering Trust in Digital Financial Services

Consumer confidence is of utmost significance in the financial sector. DORA’s compliance mechanism makes sure that institutions are well prepared to handle cyber attacks properly, preventing data breaches and financial fraud, thereby boosting confidence in online finance.

Key Requirements for DORA Compliance

Five major pillars are needed by financial institutions to meet DORA:

- ICT Risk Management – Set up governance structures for IT risk identification, assessment, and management.

- Incident Reporting – Have a standard process for reporting, identifying, and reacting to cyber incidents.

- Operational Resilience Testing – Periodic penetration testing and threat evaluation for vulnerability testing of systems.

- Third-Party Risk Management – Ensuring ICT vendors are compliant and there is no security risk.

- Information Sharing – Facilitating the sharing of threat intelligence on the cyber side to improve overall industry preparedness.

Challenges in Implementation of DORA

Though having advantages, banks, and financial institutions also have some challenges to fully comply with DORA:

Unreasonably Excessive Costs of Implementation: Advanced cybersecurity infrastructure, employee training, and compliance can be out of the question. The majority of financial institutions, particularly smaller ones, will not be able to fund upgrades. Compliance involves paying to install advanced security products, regulators’ inspections, and employee training workshops to ensure they comply with the guidelines in DORA.

IT System Sophistication: Large financial institutions with ageing systems may struggle to absorb new models of resilience. IT aging systems are inflexible and do not allow for the adoption of new cybersecurity shields, since that is their natural inclination to resist innovations. Regulation is slow and arduous in this case. Institutions must undertake full-scale system overhauls or employ the use of middleware to bridge the gap between old and new technology.

Third-Party Dependencies: Vendor compliance is difficult to control since ICT service providers must also comply with DORA regulations. Banks are reliant on third-party technology companies for cloud, cybersecurity solutions, and digital payment systems. They must make their external partners conform to DORA standards through strict contractual conditions, regular audits, and continuous risk monitoring.

Changing Cyber Threat Landscape: Banks are forced to continuously reinvent as a result of new and state-of-the-art cyber attacks. Cybercriminals continue to evolve sophisticated advanced attack methods such as ransomware, phishing, and AI-based cracking strategies. Businesses are required to remain compliant by remaining attuned to threats through dynamic cybersecurity processes, ongoing vulnerability checks, and ongoing improvement culture of the organization.

The Future of Digital Finance under DORA

The future of digital finance within the EU is about to change completely with the DORA. The effects are:

Enhanced Market Resilience: A more resilient financial sector with diminished cyber threats and business losses. Through implementing stringent cybersecurity measures, DORA enables financial institutions to enhance their operational resilience so they can better cope to absorb and bounce back from cyber-attacks, hence minimizing economic and reputational loss.

Increased Adoption of New Technologies: Promoting the use of AI-based security measures, blockchain-based financial transactions, and real-time fraud detection platforms. As institutions strive to gain compliance, they will consequently employ new technologies that improve security, automate processes, and enhance customer experience.

Increased Global Competitiveness: EU leadership of global regulation of digital finance will set a global standard, and the same policy will be followed throughout the globe. By creating far-reaching standards on cybersecurity and resilience, DORA makes the EU a global rule-maker in the regulation of digital finance, poised to inspire other regions to do the same.

Increased Consumer Confidence: With secure cybersecurity, consumers will feel more confident in using online banking, payment, and investment portals. The confidence in effective operating resilience will minimize breaches of data as well as fraud issues, enhancing further confidence in the online financial environment.

Conclusion

DORA is a foundation of the EU Digital Finance Strategy to allow financial institutions to operate in a safe, resilient, and regulated digital environment. By aligning its mission with the strategy, DORA supports financial stability, aligns resilience levels, and inspires trust in digital financial services.

While there are obstacles, such as high implementation expenses, complexity in IT systems, and emerging cyber threats, the long-term benefits of compliance outweigh these barriers. The banks that successfully implement DORA’s guidance will be able to gain an edge, showing their commitment to cybersecurity and operational resilience.

As digital finance continues to progress, DORA Compliance will continue to be an important framework in ensuring the financial system is protected against more sophisticated cyber threats. It promotes innovation while security remains secure, allowing the financial system of the EU to be solid, resilient, and forward-looking.

0 Comments