Cybersecurity for Fintech companies is at the forefront of concerns for Fintech companies. Handling sensitive customer data, from banking credentials to payment history, means these organizations are frequent targets for cybercriminals. A single breach can result in devastating financial losses, legal ramifications, and irreparable harm to trust.

This is why robust penetration testing for Fintech Industries is vital to the industry. It helps identify vulnerabilities before malicious actors exploit them. Among the many fintech cybersecurity companies, Qualysec stands out as a trusted and reliable partner for Fintech organizations. But why do cybersecurity fintech companies consistently choose Qualysec?

We’ll explore the unique challenges of Fintech cybersecurity and unpack the reasons why Qualysec leads the pack when it comes to penetration testing in this important sector.

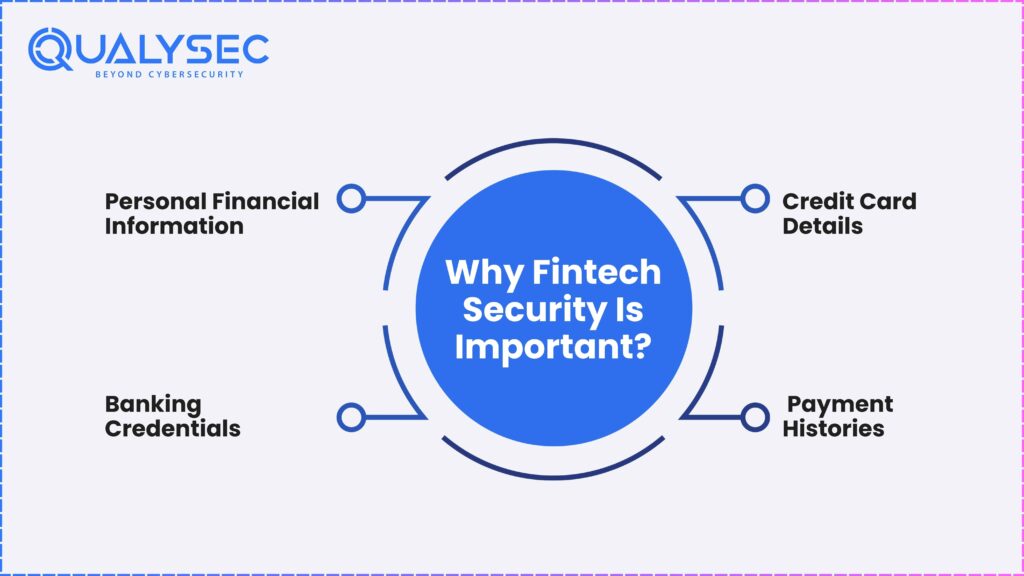

Why is cybersecurity in fintech important?

The importance of cybersecurity in Fintech industry cannot be overstated. Fintech deals directly with sensitive personal and financial information. A breach in this data can spell disaster for individuals and organizations alike. Let’s break down what’s at risk.

1. Personal Financial Information

Fintech platforms process and store masses of personal financial information, from names and addresses to income levels and spending patterns. This data is gold for cybercriminals, who can misuse it for identity theft or fraud, or sell it on the dark web.

Penetration testing for Fintech companies is vital in identifying weak points in the systems that house this information. Firms like Qualysec specialize in simulating real-world attacks to uncover vulnerabilities, ensuring that only the company and its users have access to sensitive data.

2. Banking Credentials

Banking credentials – including usernames, passwords, and account numbers—are especially enticing targets. A single breach can lead to unauthorized account access, causing financial losses and crippling customer trust.

Qualysec offers cybersecurity for Fintech companies a proactive solution to uncover breaches in applications, APIs, and networks before hackers exploit them. Their detailed and tailored reporting helps businesses understand how to shore up their defenses using financial data protection strategies for Fintech startups.

3. Credit Card Details

Payments and credit card details are at the heart of countless Fintech applications. With each transaction, there’s the potential risk of data interception. Secure handling of this data is not just about protecting customers but also about ensuring compliance with cybersecurity standards in financial services India, such as PCI DSS (Payment Card Industry Data Security Standard).

Qualysec specializes in ensuring that Fintech cybersecurity companies meet and exceed these standards, giving companies an added layer of assurance. Their penetration testing services help uncover flaws in payment systems, such as weak encryption or insecure payment gateways, that could lead to breaches.

4. Payment Histories

Payment histories reveal a significant amount about an individual, from their habits to their preferred vendors. They can be used for malicious profiling or targeted phishing attacks when exposed.

Qualysec’s penetration testing can detect vulnerabilities in data storage and transmission, ensuring sensitive payment histories are kept private. Their advanced methodologies support cybersecurity best practices for Fintech companies, helping them remain one step ahead of even sophisticated cyber threats.

A Fintech company’s reputation is based on customer trust, making effective cybersecurity not just a “nice-to-have” but an absolute necessity. This is where cybersecurity for Fintech companies and penetration testing for Fintech companies play a crucial role in preventing common cybersecurity threats in financial technology and mitigating the risks of data breaches in Fintech applications.

Talk to our Cybersecurity Expert to discuss your specific needs and how we can help your business.

Why Fintech Companies Choose Qualysec for Cybersecurity

With sensitive financial data, extensive digital transactions, and complex third-party integrations, the stakes are sky-high. A single breach can lead to legal penalties, financial losses, and a damaged reputation. Penetration testing for Fintech companies, a process that simulates real-world cyberattacks to identify vulnerabilities, is indispensable for safeguarding Fintech systems.

Among the array of fintech cybersecurity companies, Qualysec stands out as the top choice for cybersecurity for Fintech companies. But what makes Qualysec the go-to partner for securing digital financial ecosystems? Here’s an in-depth look at why cybersecurity fintech companies trust Qualysec with their cybersecurity needs.

1. Specialized Expertise in Fintech Security

Cybersecurity isn’t one-size-fits-all, especially when it comes to financial data protection strategies for fintech startups. The industry’s unique challenges demand a specialized approach, and this is exactly what Qualysec delivers.

- Understanding Fintech’s Unique Challenges

Fintech platforms involve intricate elements such as payment gateways, encryption protocols, and third-party API integrations. Unfortunately, these layers also expand an attacker’s playing field. Qualysec’s team has deep domain expertise in common cybersecurity threats in financial technology, ensuring a tailored approach to uncover potential vulnerabilities.

Their experience covers a range of systems, from mobile banking apps to cryptocurrency wallets, ensuring that even the most complex Fintech architectures are comprehensively tested with cutting-edge methods and tools aligned with cybersecurity standards in financial services India.

- Cutting-Edge Technology

Qualysec combines its Fintech expertise with the industry’s most advanced cybersecurity tools. This blend allows them to analyze complex systems thoroughly and identify vulnerabilities hidden in the unique nuances of financial technology platforms.

2. Comprehensive Security Testing Across All Layers

Fintech platforms are multi-faceted, with various components interacting seamlessly to deliver exceptional user experiences. To secure such a system, penetration testing must be thorough, leaving no stone unturned.

- End-to-End Testing for Total Security

Qualysec’s testing methodology spans multiple layers, delivering an exhaustive assessment of every component, from user interfaces to back-end servers and APIs.

Whether it’s investigating vulnerabilities in mobile apps, assessing the robustness of cloud infrastructure, or analyzing databases for potential breaches, Qualysec provides a comprehensive overview of your security posture. This ensures that risks of data breaches in fintech applications don’t slip through the cracks, no matter where they may hide.

- Safeguarding Third-Party Integrations

Fintech companies for penetration testing often rely on third-party APIs and integrations to provide services like payment processing and identity verification. These touchpoints are crucial but also pose security risks. Qualysec’s testing actively examines these external connections to ensure that vulnerabilities don’t creep in from third-party systems, aligning with identity theft prevention in financial technology services.

3. Regulatory Compliance and Risk Mitigation

The Fintech landscape is rife with rigorous cybersecurity regulations for fintech enterprises aimed at protecting consumer privacy and financial data. From PCI-DSS (Payment Card Industry Data Security Standard) to GDPR (General Data Protection Regulation), compliance is both a necessity and a challenge.

- Going Beyond Compliance

While many providers stop at ensuring compliance with standard regulations, Qualysec goes further by identifying overlooked risks that could lead to legal and reputational consequences. Their detailed testing process evaluates whether your systems not only meet but exceed existing compliance requirements, helping clients stay in line with cybersecurity standards in financial services India.

From analyzing user data flows to assessing encryption methodologies, Qualysec delivers clear, actionable insights aligned with regulatory standards. Fintech companies can rest assured that they’re meeting both legal and ethical obligations.

- Proactive Risk Reduction

Cybersecurity best practices for fintech companies are all about mitigating risks before they become liabilities. Qualysec equips Fintech firms with the tools and insights to proactively identify and fix weak points, preparing them to handle evolving threats and stay ahead of attackers.

4. In-Depth Manual Testing and Vulnerability Discovery

Automated penetration testing tools are widespread and fast, but they have their limitations. Qualysec combines the precision of automation with the depth of manual testing to uncover hidden security risks in cybersecurity for Fintech companies.

- Mimicking Real-World Attacks

Sophisticated cyberattacks don’t follow predictable patterns. Qualysec’s cybersecurity experts go beyond automated scans by simulating real-world attack strategies. Whether it’s bypassing complex authentication mechanisms or assessing business logic, their team explores every angle hackers might use to infiltrate a system.

- Discovering Complex Vulnerabilities

Automation can miss conceptual flaws like roles-based misconfiguration, logical errors, or context-specific vulnerabilities. Qualysec’s manual testing ensures that even these hard-to-spot issues are identified and addressed, offering an extra layer of protection that solely automated tools cannot provide.

5. Post-Test Support and Remediation Guidance

Testing isn’t enough; remediation is equally crucial. After vulnerabilities are identified, Fintech companies need actionable solutions, and that’s where Qualysec truly shines.

- Clear Reporting

Qualysec provides clients with detailed, easy-to-understand vulnerability reports. These reports prioritize issues based on risk level, enabling teams to focus their resources on the most critical vulnerabilities first—an essential part of how fintech companies can improve cybersecurity.

- Expert Guidance

Beyond reporting, Qualysec works closely with Fintech companies to provide step-by-step guidance for fixing identified security issues. From recommending best practices to realigning processes, their post-test support ensures companies can implement sustainable security measures with minimal disruption to operations. This guidance highlights the importance of cybersecurity in fintech industry operations.

Qualysec empowers these businesses with the insights, tools, and expertise they need to maintain their competitive edge while staying secure. Our tailored approach to Fintech cybersecurity, from specialized expertise and comprehensive testing to regulatory alignment and in-depth guidance, has made them a trusted partner for industry leaders. When it comes to cybersecurity for Fintech companies, going halfway simply isn’t an option. Qualysec makes it inherently more resilient, instilling confidence in your systems, teams, and customers alike, especially important in the age of common types of financial scams in India.

Real-Life Example – QualySec Secured Fintech Global with VAPT

Client: Fintech Global – A digital payments and lending platform.

Challenge: With new features launched, Fintech Global needed to ensure its platform, especially APIs and user authentication, was secure and compliant with fintech standards.

Solution: QualySec conducted end-to-end VAPT, covering the web app, mobile app, and backend APIs. We tested for OWASP Top 10 vulnerabilities, business logic flaws, and performed remediation verification.

Results:

- Found 38 vulnerabilities, including 6 high-risk ones like IDOR and broken authentication.

- Helped the client fix all issues with clear, actionable guidance.

- Passed ISO 27001 & PCI-DSS aligned audit post-testing.

- Improved platform stability and reduced security-related support issues by 25%.

Latest Penetration Testing Report

Future-Proof Your Fintech Security

When it comes to safeguarding sensitive financial information, cybersecurity for fintech companies can no longer afford to take a reactive approach. Proactive penetration testing for fintech companies is the key to staying ahead of increasingly sophisticated threats and protecting customer trust from common cybersecurity threats in financial technology.

Qualysec’s proven expertise, comprehensive testing methodologies, and commitment to continuous improvement make it a go-to partner among leading fintech cybersecurity companies. With a deep understanding of cybersecurity best practices for fintech companies and the importance of cybersecurity in fintech industry, we support businesses in aligning with evolving cybersecurity regulations for fintech enterprises and enhancing financial data protection strategies for fintech startups.

Partner with Qualysec today, and ensure your systems are built not just for today, but for the threats of tomorrow, because how fintech companies can improve cybersecurity starts with the right partner. Protect against identity theft prevention in financial technology services and address the risks of data breaches in fintech applications with a trusted name in cybersecurity fintech companies. Discover what Qualysec can do for your fintech business. Request a free consultation!

0 Comments